Cross-Validation Rules in NetSuite

Faster close.

Cleaner data.

Cross-Validation Rules (CVRs) by Netgain give NetSuite users a powerful way to prevent errors at the source. Automatically block any mix-up of account, subsidiary, segment, transaction field or user on every transaction type, so errors never reach your general ledger.

Big-league ERPs like Oracle, SAP, and Dynamics have shipped this safety net for years; now NetSuite users finally get the same protection.

Cross-Validation Rules

Why choose Cross-Validation Rules for your month-end close?

Keep your numbers clean, close faster, and stay audit-ready—without spreadsheets or late-night reclasses.

Give Cross-Validation Rules a try with our interactive demo

Validate journals, vendor bills, customer invoices, checks, intercompany entries, and much more, including custom transaction types, so nothing slips through the cracks.

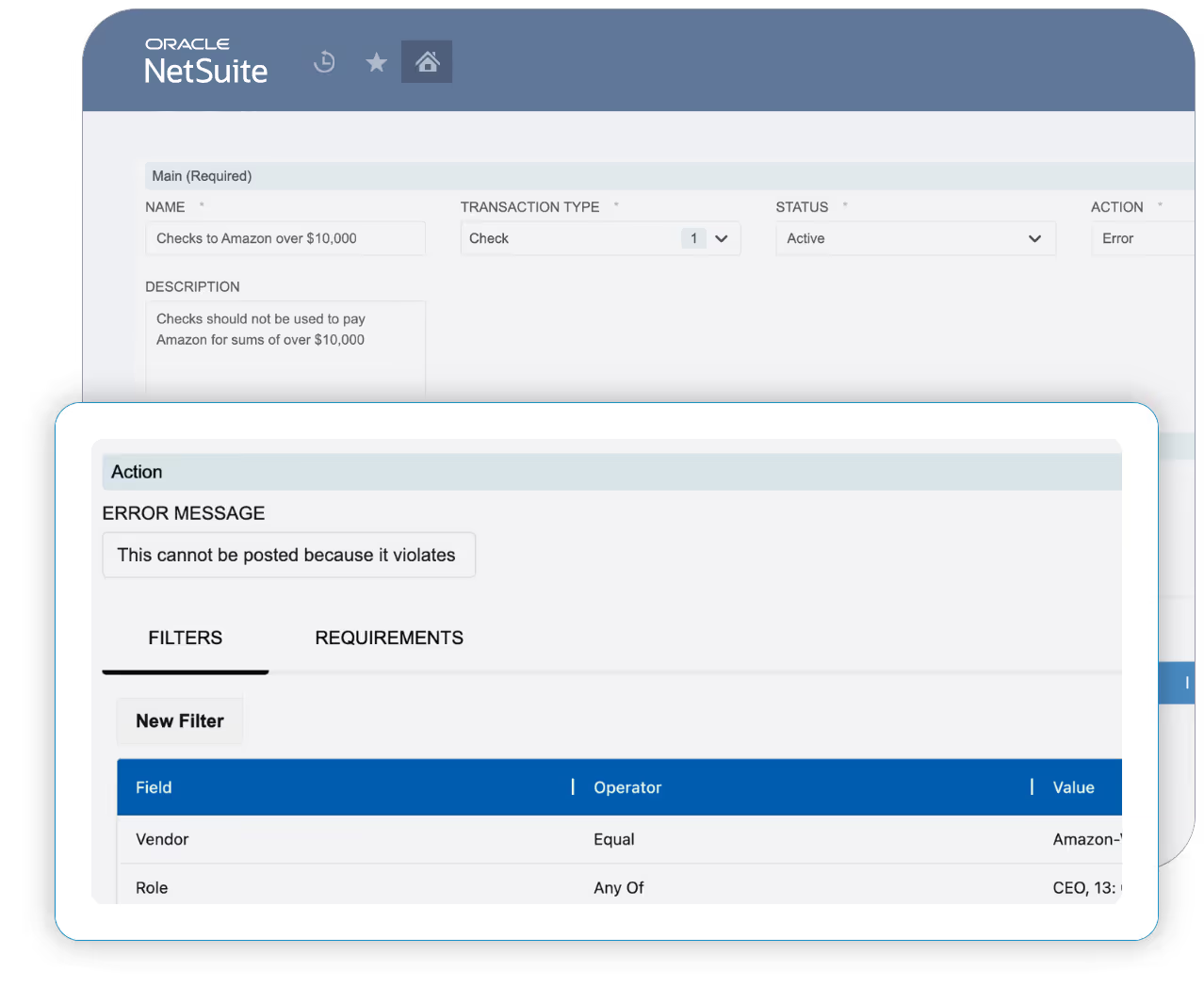

Build rules across native and custom segments with “must be,” “cannot be,” or range logic. Limitless combinations, zero coding.

Users see an instant, friendly pop-up explaining why a transaction is blocked and how to fix it—turning close-time corrections into real-time learning.

Finance admins (not developers) own the rule set with an intuitive point-and-click interface.

Cross-Validation Rules FAQs

Cross-Validation Rules (CVRs) are automated checks that prevent invalid combinations of accounts, departments, classes, locations, subsidiaries, or custom segments from being posted in NetSuite. By blocking errors at the point of entry, CVRs help finance teams keep data clean and accelerate the month-end close.

Many delays in the financial close come from correcting mis-coded entries. With CVRs, errors are stopped before they reach the general ledger. This means fewer reclasses, faster reconciliations, and a smoother month-end close cycle.

A clean ledger is the foundation of a fast close. Cross-Validation Rules reduce manual corrections, cut down rework, and improve compliance—giving controllers and CFOs the confidence to close the books faster and more accurately.

Yes. Netgain’s Cross-Validation Rules are built with a click-to-configure designer. Finance admins can create rules in minutes without IT support, making it easy to adapt as your business grows.

Because CVRs prevent errors at the source, your month-end and year-end financials are cleaner. This reduces the risk of control breakdowns and ensures you’re always audit-ready.

Manual detective controls rely on after-the-fact reviews and spreadsheets, which slow down the financial close. Cross-Validation Rules automate those checks directly in NetSuite, giving you proactive error prevention instead of reactive fixes.

See why Netgain is trusted by thousands of accounting teams

Say goodbye to your insane workload.

Say hello to fearless financials. Meet Netgain.