You may find yourself asking, “Where did deferred rent go? How do I account for operating leases under the new lease accounting standards?” This article will explain how deferred rent was recorded for operating leases under ASC 840 and how to properly account for operating leases under ASC 842.

Key Takeaways:

- Under ASC 840, deferred rent was used to record the difference between the monthly lease expense and monthly lease payments

- Under ASC 842, deferred rent is no longer recorded and is replaced by a Right-of-Use (ROU) Asset and Lease Liability

- NetLease by Netgain automates lease calculations to ensure GAAP compliance

Deferred Rent Under ASC 840:

Under ASC 840, for operating leases, deferred rent was used to record the difference between the monthly lease expense (sum of payments throughout lease divided by lease term) and monthly lease payments:

Deferred rent, a liability, increases with a credit and always reduces to a zero balance at the end of the lease. As noted above, deferred rent exists when the monthly lease expense varies from the lease payment. This difference can be caused by an abatement period, initial direct costs, rent increases, prepaid expenses or lease incentives. If none of these are present in the lease, the monthly lease expense will equal the lease payment, and deferred rent will not be recorded.

Example 1

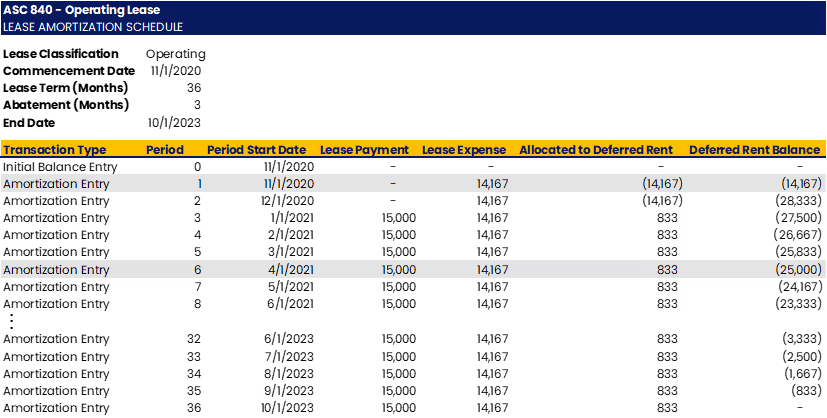

As seen in the schedule below, this lease contains a three-month abatement period during which the lessee is not required to make lease payments.

During this abatement period, deferred rent will increase each month by the amount that the lease expense exceeds the lease payment.

Once the abatement period ends, monthly payments will exceed the monthly lease expense. This will reduce the deferred rent balance each month until it reaches zero at the end of the lease.

Deferred Rent Under ASC 842:

Under the new guidance in ASC 842, for operating leases, deferred rent is no longer recorded. In its place, Right-of-Use (ROU) Asset and Lease Liability are recorded. Each is reduced in subsequent periods, ending in zero balances at the end of the lease.

The Lease Liability represents the present value of the lessee’s obligations under the terms of the lease (ASC 842-20-30-1).

The ROU Asset represents the lessee’s right to use the leased asset. It is calculated as the sum of the lease liability, prepaid lease payments and initial direct costs minus any lease incentives (ASC 842-20-30-5).

Example 2:

As seen in the schedule below, this is the same lease as Example 1. Additional details, such as incremental borrowing rate and prepaid lease payments, have been added to support necessary calculations.

An initial entry records the ROU Asset and Lease Liability:

In subsequent months, the difference between the lease expense and lease payments will be recorded as adjustments to the ROU Asset and Lease Liability rather than deferred rent.

For certain short-term, low-value leases, companies may elect a short-term lease exemption and account for the lease in a manner similar to ASC 840 (including use of deferred rent).

NetLease Makes Operating Leases Easy:

Accounting for operating leases under ASC 842 involves building out schedules to calculate and track items such as interest accretion and ROU asset balances. NetLease by Netgain automates these schedules.

NetLease also automates monthly amortization journal entries as well as entries to transition from ASC 840 to ASC 842.

Bottom Line:

Deferred rent is replaced by an ROU Asset and Lease Liability under ASC 842. Accounting for the transition from ASC 840 to ASC 842 can be complex and time-consuming. NetLease by Netgain can simplify the process by automating your amortization and reclassification entries, billing and lease calculations to ensure you are GAAP compliant.

FAQs

What is deferred rent?

In lease accounting, deferred rent occurs when the cash rent payments diverge from the reported financial statements. This frequently happens when a lessee receives free rent for one or more periods.

Consider the following as a practical example. The Vice President of Real Estate in an organization purchases a new location asset for the firm and, in doing so, negotiates a term free of rent payments at the beginning of the lease since the firm needs time to plan its move-in and finish the interior of the new location. Deferred rent will be reflected on the lessor's balance sheet throughout that free rent term.

What happens to deferred rent under ASC 842?

Deferred rent is no longer recorded for operating leases in accordance with the new ASC 842 guidance. Right-of-Use (ROU) Asset and Lease Liability are recorded in its place. By the end of the lease, each balance is zero because it has been reduced in consecutive periods.

The Lease Liability is the present value of the Lessee's lease-related obligations (ASC 842-20-30-1).

How do you account for deferred rent?

The following accounting rules apply to the free rent period and subsequent periods:

Total the rent payments made over the course of the lease. Then, divide this total payment amount by the total number of lease periods, including any early termination time. So although the first month was technically “free,” we still have a payment that appears on our balance sheets.

What is deferred rent under ASC 840?

Companies employed the deferred rent balance sheet item under ASC 840 to enable straight-line rent spending. Companies kept cash for rent that wasn't equivalent to the average rent required by ASC 840 in the delayed rent account. The account is not needed according to ASC 842. Yet, the idea is still in use at the moment.

Does ASC 842 apply to rent?

For private corporations with a calendar year-end starting January 1, 2022, the new lease accounting standards under ASC 842 went into effect. Real estate leases for both renters and landlords will be impacted by these new regulations, which mandate that businesses report nearly all leases on their balance sheets.

Tenants, who under ASC 840 have primarily recorded their leases off balance sheets, may notice a substantial change. Although these regulations won't have as much of an impact on landlords, there are some subtleties that they should be aware of.

Is deferred rent the same as accrued rent?

Deferred rent results from a discrepancy between the amount of the straight-line expense recorded and the cash paid for rent in the reporting period. Accrued rent happens when the timing of rent expense incurred differs from when payments are due.

Accrued rent is caused by a timing discrepancy between the expense being incurred and recorded. For instance, if payments are made at the end of each quarter on a quarterly basis, expenses must be reported each month prior to payment. Accruing an expense is the process of recognizing it when the business is required to pay for the use of an asset but before the payment is actually made. Anytime the rent is paid, the amount paid is deducted from the accrued rent.

When cash paid for rent increases or decreases throughout the course of the lease, the outcome is deferred rent, which is reported as a straight-line expenditure. There will be times when the actual cash being paid (or not paid) is different from the average of all lease payments to be made over the life of the lease if the lease involves rent holidays, prepayments, rent escalations, or de-escalations.

How do I record deferred rent revenue?

Deferred revenues are not included on the income statement since they are not recorded until they are earned. Instead, they are listed as a liability on the balance sheet. The liability is reduced and revenue is recorded as the income is earned.

What is the difference between prepaid rent and deferred rent?

There is a distinction between prepaid and deferred rent. Deferred rent is a liability that occurs when the lessor offers free rent, usually at the beginning of the lease term, or when rent payments are increasing. Prepaid rent is rent paid before utilizing the rented asset. It is then expensed as the asset is used.

How is deferred rent treated?

The new lease accounting guidance explicitly states that following the commencement of an operating lease, the ROU asset will be adjusted for several items, including any prepaid or accrued lease payments. Delayed rent is either accrued rent or prepaid rent, depending on whether it is a cumulative positive or negative amount.

The most common kind of deferred rent is a liability, or credit balance, that represents cumulative rent expense, where the total rent expense recognized exceeds all cash payments up to that point in time. Unless the cash payments exceed the expense recognized and the cumulative liability is zeroed off, the excess expense above the total cash paid has been accrued or delayed.

.avif)